The UNMC Benefits Office has composed a list of the most frequently asked questions concerning benefits. This week, UNMC Today will have articles addressing those questions. If someone has a specific question that was not addressed in the articles, please reach out by email to the Benefits Office.

Today’s question and answers will go over dental and vision coverage offered by the University.

DENTAL

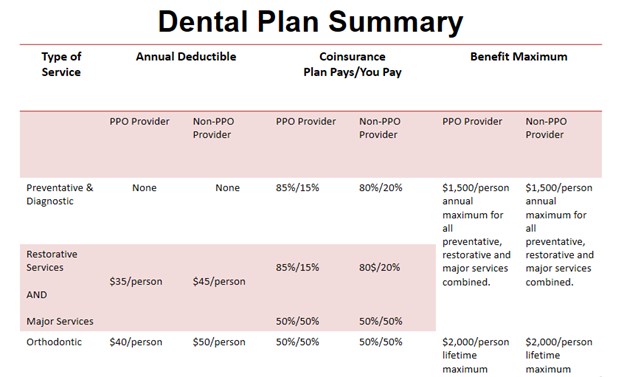

Q: How do the deductible, co-insurance and stop-loss apply to the Ameritas dental coverage?

A: Please see the Dental Plan Summary below. Preventative and Diagnostic Services, such as teeth cleaning, do not have a deductible; however, there is a co-insurance. If the services were provided at a preferred provider, the co-insurance will be 85%/15%, meaning you will be responsible for 15% of the bill. Under Restorative and Major Services, there is a $35 deductible, meaning that the first $35 of the bill will be your responsibility. The remainder is then applied to the co-insurance.

This plan has a $1,500/person annual maximum benefit. This means that the maximum amount the insurance will pay on a covered person each calendar year, which includes Preventative, Restorative and Major Services, is $1,500. This benefit maximum restarts every year on Jan. 1.

Q: Where can I find more information on my dental benefits, such as finding a preferred provider or getting a cost estimate on a procedure?

A: Please visit the Ameritas Dental website and create an account. Once you log in and click on the Dental icon, you are able to review claims, request ID cards, find a preferred dental provider and get a cost estimate for various procedures.

Q: Who can utilize the orthodontia benefit under the dental coverage?

A: The orthodontia benefit can be utilized by anyone on this coverage. This does include Adult orthodontia.

Q: What is the coverage for orthodontia?

A: The covered individual who utilizes this service will have a $40 deductible. Once this is paid, there is a 50%/50% co-insurance. At that 50% rate, the insurance will pay a life-time maximum amount of $2,000.

Q: Can I continue this coverage as a retiree?

A: Yes. Please contact the benefits office to request additional information concerning retiree benefits.

VISION

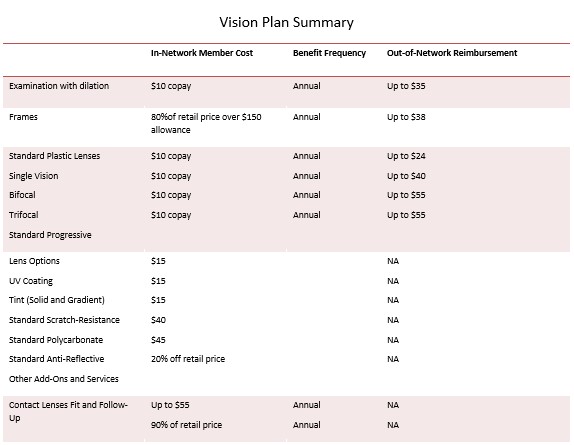

Q: What are co-pays and how do they work?

A: Co-pays are fixed amounts you pay for services. Below is a list of all the services provided by vision coverage, as well as the co-pays for each.

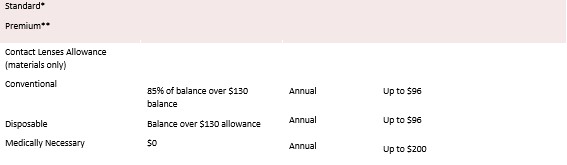

Q: How does the frame/contact allowance work?

A: Each year covered individuals are given a $150 allowance for frames and $130 for contact lenses. An example of how this works would be purchasing a $200 pair of frames. Insurance covers the first $150. The remaining balance is $50. The covered individual then will be responsible for 80% of the remaining cost of the frames; in this example that would be $40 and insurance would pay an additional $10. In addition to the remaining balance on the frames, the employee will be responsible for the co-pays on the lenses and any coatings added.

Q: Do we have a Lasik benefit?

A: Our plan provides covered dependents a 15% discount on Lasik or a 5% discount on promotional pricing.

If you have questions or concerns pertaining to benefits enrollment, please contact the Benefits Office to schedule a one-on-one meeting. Meetings can be scheduled via email or by calling 402-559-4340.