Tag: rate

Physician Finance: Retirement – The Advantages of Tax-Advantaged Retirement Accounts

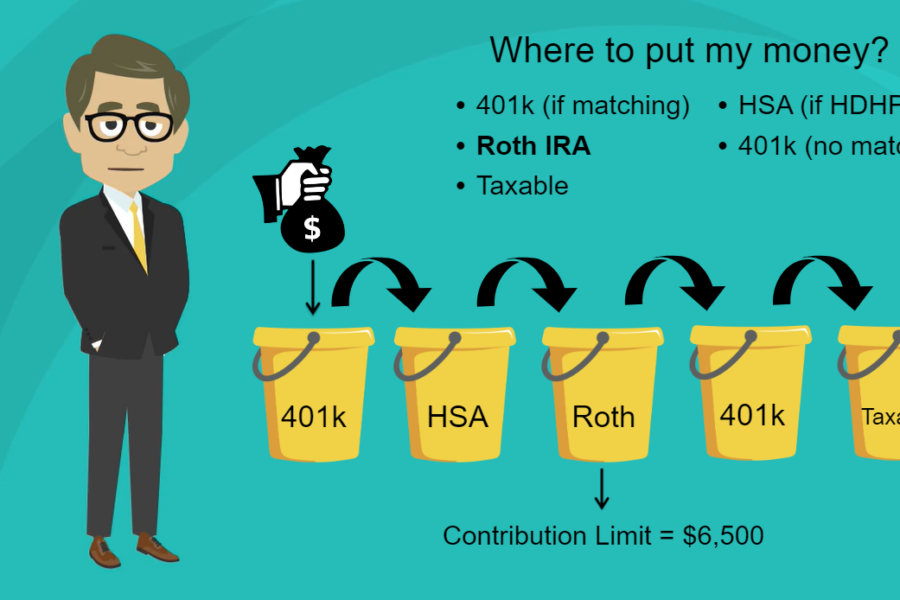

This module identifies the difference between marginal and effective tax rates, the tax advantages of using tax-advantaged retirement accounts, and the tax-advantaged retirement accounts that are best during low-income years and which are best during higher-income years.

Mar 15, 2024

Physician Finance: Retirement Part 1

This e-module identifies the barriers to physician’s retirement, factors that impact how much money to save for retirement, and the factors that impact the ability to save enough for retirement.

Aug 28, 2023

adjustable, afford, buying, escrow, fixed, interest, loan types, mortgage, points, process, rate, refinance

Physician Finance: Housing Part 2 – Buying a Home

This module identifies resources to determine how much house you can afford. It also discusses fixed and adjustable rate mortgages and defines the Escrow Account.

Jan 24, 2023