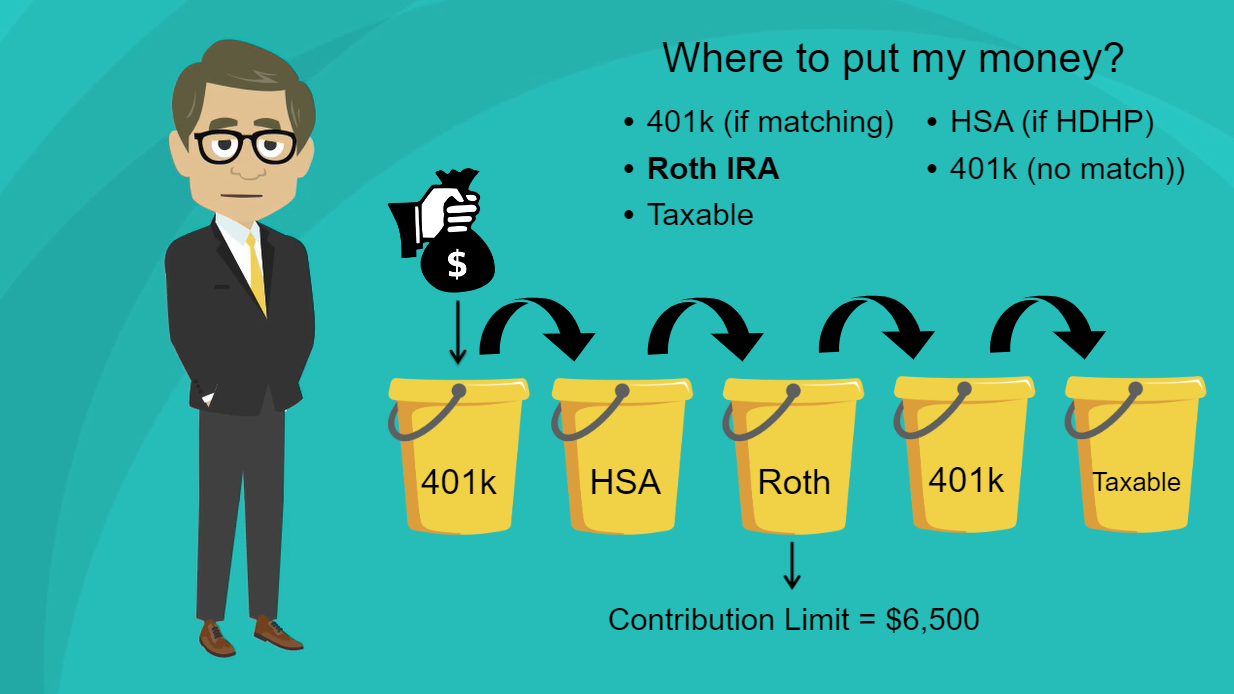

This module identifies the difference between marginal and effective tax rates, the tax advantages of using tax-advantaged retirement accounts, and the tax-advantaged retirement accounts that are best during low-income years and which are best during higher-income years.

Category: Education, Research, Wellness

Format: E-Learning Module

Development Date: March 15, 2024

Discipline: Medicine